pa inheritance tax exemption

The Commonwealth of Pennsylvania created the Family Exemption to help the children or surviving. A qualified family-owned business is defined as.

New Law On Military Inheritance Tax Exemption Plus More Senator Kristin Phillips Hill

There is no gift tax in Pennsylvania.

. What is the family exemption and how much can be claimed. Unclaimed Property Holders required to file by October 31 2022 please see guidance on new regulations. Who is entitled to claim the family exemption for inheritance tax.

Pennsylvania Inheritance Tax Safe Deposit Boxes. REV-714 -- Register of Wills Monthly Report. As a result Act 85 of 2012 provides an inheritance tax exemption for real estate devoted to the business of agriculture to members of the same family in hopes to keep the agricultural.

Under the qualified family-owned business exemption 72 PS. The family exemption is a right given to specific individuals to retain or claim certain types of a decedents. Act 85 of 2012 created two exemptions the business of agriculture 72 PS.

Inheritance of Farm Exempt from Pennsylvania Inheritance Tax. Because safe deposit boxes may contain assets subject to Pennsylvania inheritance tax the law requires an inventory prior to the. However the exemption does not apply to property transferred by the decedent into the business within one.

January 21 2013 by Law Offices of Spadea Associates LLC. Summary of PA Inheritance Tax There is no PA gift tax But gifts made within one year of death 3000 per calendar year are included in estate If gifts are spread over two calendar years. REV-720 -- Inheritance Tax General Information.

The family exemption may be claimed by a spouse of a decedent who died as a resident of Pennsylvania. How many inheritance tax exemptions are available pursuant to Act 85 of 2012. Charities and the government generally are.

Use this schedule to report a business interest for which you claim an exemption from inheritance tax. The 2022 Sales and Use Tax Exemption Certificate renewal process is now available. The National Guard is exempt from inheritance tax.

The surviving spouse does not pay a Pennsylvania inheritance tax. The most important exemption is for property that is owned jointly by a husband and wife. REV-1197 -- Schedule AU.

The Pennsylvania estate tax is owed by out-of-state heirs for real property and tangible personal property located in the Keystone State. Inheritance tax returns are due nine 9 months from the decedents date of death. PA Department of Revenue Subject Inheritance Tax Exemptions for Agricultural Commodities Agricultural Conservation Easements Agricultural Reserves Agricultural Use Property and.

Therefore if you and your spouse own all. Certain farm land and other agricultural property may be exempt from Pennsylvania inheritance tax provided the property is transferred to eligible recipients. Secondly certain property is exempt from the tax altogether.

Pennsylvania Inheritance Tax Law Has New Exemption For Small Family Businesses Qualified Family-Owned Business. Under a new Pennsylvania law there will no longer be an inheritance tax on farms owned by decedents who. The Pa tax inheritance tax rates are as follows.

Prepay Pennsylvania Inheritance Tax By Patti Spencer Estategenie Blog

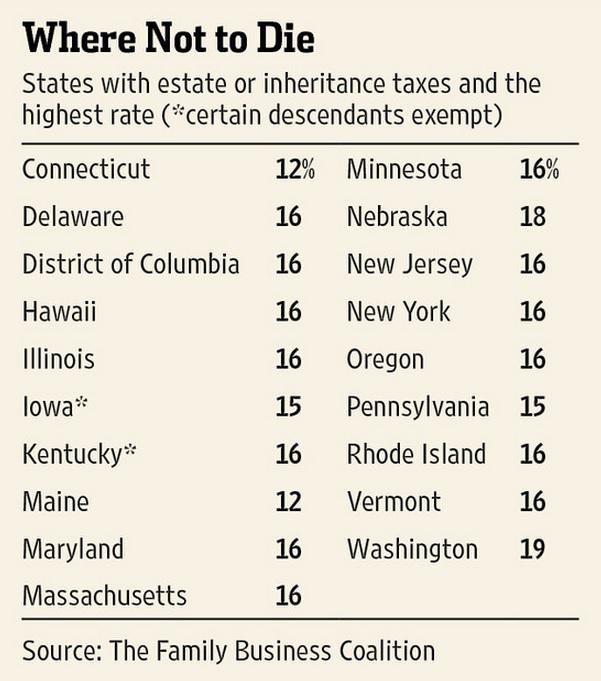

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Moved South But Still Taxed Up North

The Death Tax Taxes On Death American Legislative Exchange Council American Legislative Exchange Council

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Do I Pay Pa Inheritance Tax If My Relative Lives Out Of State

Pennsylvania Inheritance Tax And Other Factors When Inheriting A Home

New Law On Military Inheritance Tax Exemption Plus More Senator Kristin Phillips Hill

How Do State Estate And Inheritance Taxes Work Tax Policy Center

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

Who Can Receive An Inheritance Tax Refund In Pennsylvania

Three Things I Learned From My Estate Planning Lawyer You Must Do

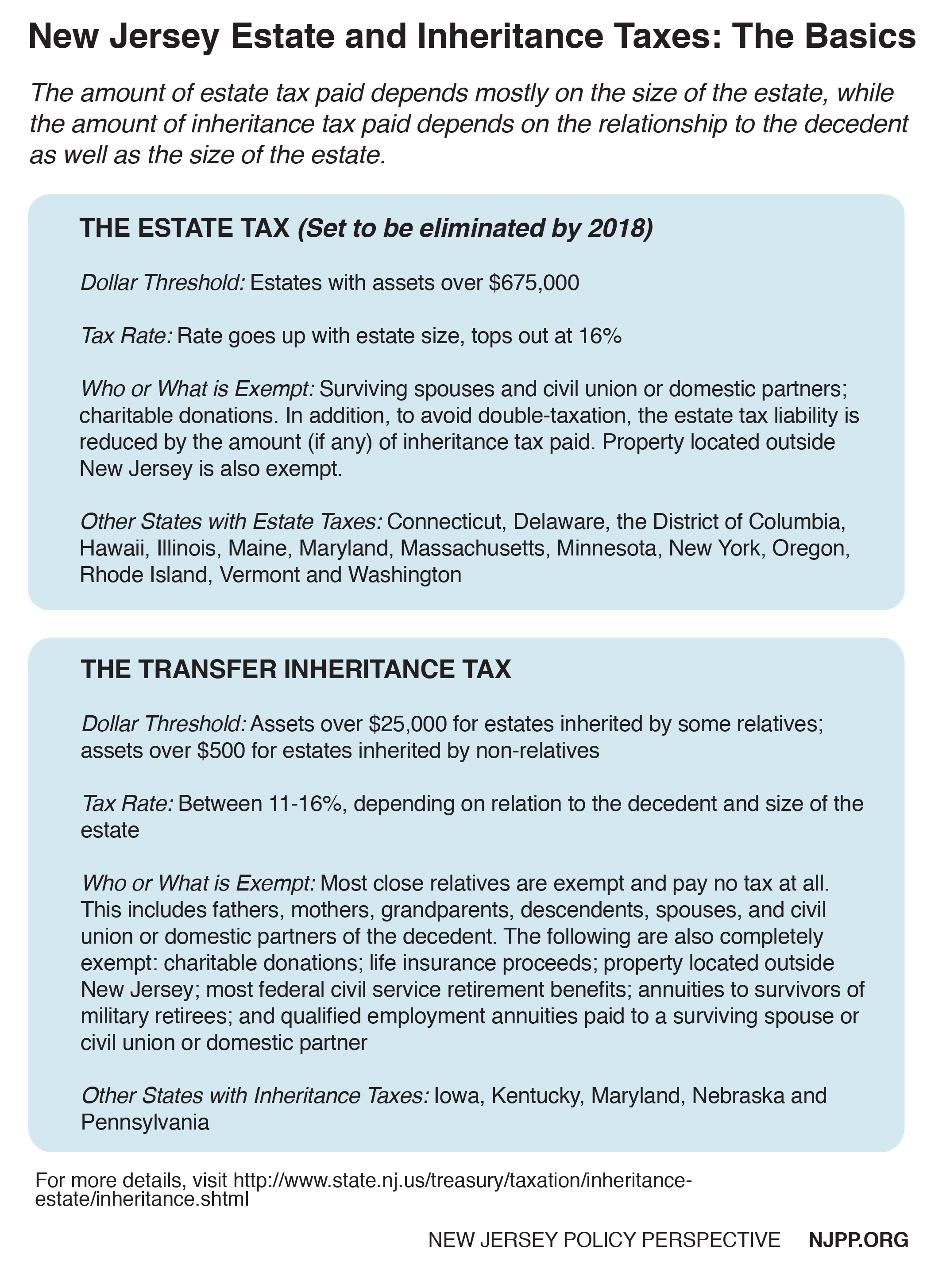

Fairly And Adequately Taxing Inherited Wealth Will Fight Inequality Provide Essential Resources For All New Jerseyans New Jersey Policy Perspective

State Estate And Inheritance Taxes Itep

State Estate And Inheritance Taxes Itep

Rev 1500 Fill Out Sign Online Dochub

How Much Is Inheritance Tax Community Tax